With 2024 within the books, leisure golf stays on the upswing.

Whereas the unprecedented progress seen in the course of the pandemic has slowed, golf trade tendencies point out that the sport is extra in style than ever.

One contributor? The rising participation amongst 18–34-year-olds, which reached a close to decade-high in 2023. With Gen Z and Millennials key to the trade’s future, it’s important to grasp how and why they have interaction with the sport.

What attracts them to golf? The place and with who’re they enjoying? What are their spending habits? And the way do their motivations differ from these of older generations?

We analyzed survey information from greater than 700 North American golfers to uncover what drives leisure golf participation throughout completely different generations heading into a vital 2025.

Self-care on the course? Golfers are drawn to golf’s psychological well being advantages

{Golfing} solo is gaining traction with youthful golfers

Gen Z and Millennials view memberships and passes as worth drivers

Golfers flip to tech for social, laid-back, distinctive golf experiences

2025 Golf Trade Developments Report

Need to study extra in regards to the state of the trade in 2025? Obtain our free report now!

1. Self-care on the course? Golfers are drawn to golf’s psychological well being advantages

Golf is as a lot a psychological sport as it’s a bodily one—and that’s a part of its attraction. Even in the course of the worst rounds, gamers have time to disconnect, immerse themselves within the sport, set targets and overcome challenges.

And if all else fails, it’s nonetheless a number of hours spent open air, whether or not alone, with pals or with household.

As golf attracts extra Gen Z and youthful Millennials, its attraction as a supply of psychological well-being, connection and refuge is obvious.

A majority of Gen Z (51%) ranked psychological well being and self-care as the highest motive they play golf

It was the third-most in style response (47%) amongst 25-34-year-old Millennials and Xennials (older Millennials on the cusp of Gen X)

General, private well-being emerged as a main driver of participation throughout all age teams

With well being and self-care fueling its recognition, golf has grow to be greater than a pastime. It’s a revitalizing outlet for youthful adults looking for stability of their lives.

Key takeaways

Promoting golfers on a life-style, a sense or an emotion is an important a part of any advertising and marketing technique. Based mostly on the insights above, how will you place your course as a constructive outlet for psychological well being and private well-being?

Non-public golf equipment usually excel at this, and public and semi-private amenities ought to take discover. You’ll be able to emphasize:

Your course’s pure magnificence and setting

The sense of group you foster

The constructive feelings golfers affiliate with enjoying your course

Distinctive occasions or experiences that differentiate your facility

The standard of your facilities: apply areas, eating, and so on.

By showcasing these components, you’ll be able to place your facility as greater than only a place to play. It turns into a vacation spot that resonates with golfers on a deeper, extra private stage.

2. {Golfing} solo is gaining traction with youthful golfers

Inexperienced grass golf is not only a bunch exercise. Generally, it’s a great strategy to take time for your self.

For Gen Z, Millennials and Xennials drawn to golf for private well-being, enjoying solo or as a single is one thing they search out frequently.

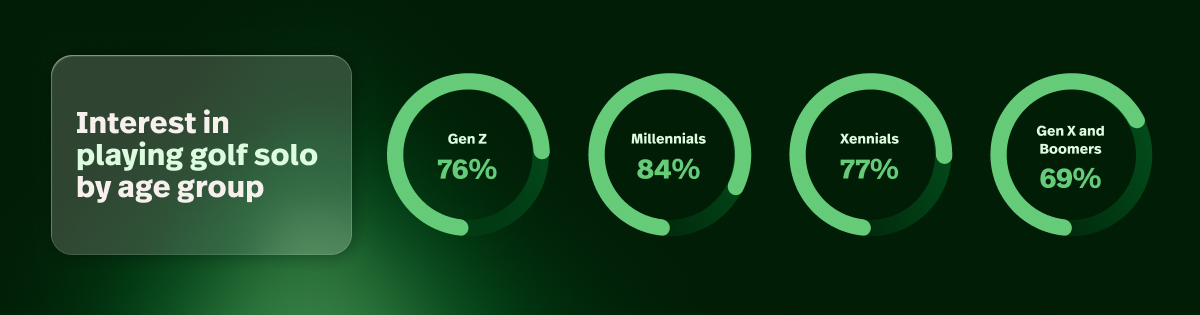

Whereas a majority of golfers throughout all age teams mentioned they might play a spherical of golf solo or as a single, the share was highest amongst youthful Millennials (ages 25-34) at 84%.

Curiosity was decrease amongst older generations, with 69% of 55-65+ golfers saying they might golf solo.

However how does this translate into precise enjoying habits?

How usually would you play a spherical of golf by your self?

In accordance with our survey information, solo golf is generally favoured by youthful generations of golfers:

Gen Z

Millennials

Gen X and Boomers

All the time or primarily

29%

21%

14%

Each time I can

39%

39%

32%

Every so often

32%

40%

55%

Notably, almost a 3rd (29%) of Gen Z golfers we surveyed mentioned they all the time or primarily search out solo/single tee instances. One other 39% mentioned they accomplish that at any time when attainable—a determine matched amongst Millennials.

Gen X and Boomers had been extra ambivalent about enjoying solo, with most saying they wouldn’t thoughts doing it from time to time.

So, why are golfers going solo?

A majority (51%) of Gen Z respondents mentioned solo golf was very best for self care and taking time for themselves

Self-care was additionally the highest response (39%) amongst all Millennial survey respondents

Over a 3rd of Millennials (36%) mentioned reserving solo made it simpler to suit golf into their schedules

Centered apply ranked among the many high three advantages for golfers throughout all age teams

Key takeaways

Whereas personal golf equipment might discover it simpler to accommodate absolutely solo play, daily-fee amenities depend on filling their tee sheets to maximise income.

However, operators and their groups ought to take these rising golf trade tendencies round solo golf severely.

Make life simple for singles: Overview your reserving coverage and the way nicely it caters to golfers who ebook as singles. Is it seamless and truthful? Does it deter singles from reserving? Does it present flexibility and permit golfers to play by themselves within the occasion of an open tee sheet?

Get artistic: Whether or not through off-peak instances or particular promo days, is there a strategy to carve out instances for solo golfers to benefit from the course on their very own?

Put money into your apply amenities: Golfers throughout all age teams worth solo apply time. Investing in your apply space and advertising and marketing it as the right place for golfers to spend a while on their very own, hone their swings and get higher is a sound tactic.

Deal with tempo of play: Lastly, 31% of golfers recognized sooner tempo of play as a key advantage of enjoying alone. Solo golf apart, tempo of play is a serious ache level for each day payment gamers. Addressing this problem is vital for enhancing buyer experiences.

3. Gen Z and Millennials view memberships and passes as worth drivers

Memberships are usually considered higher suited to the life-style of older generations of golfers. However with each day payment golf rising costlier, a majority of youthful golfers see memberships and passes as very best for his or her wants: they’re cost-effective options that permit them play extra and maximize worth as the price of golf grows.

Golfers planning to buy a membership or season go at a course subsequent season by age group:

18-24

25-34

35-44

45-54

55-64

65+

71%

76%

70%

64%

54%

35%

Whereas 66% of all survey respondents indicated they might buy a membership or season go, Gen Z and Millennials had been probably the most motivated. Almost three quarters (74%) of 18-34 golfers mentioned they plan on buying a membership or season go at a facility subsequent season.

Notably, this majority was constant throughout family earnings brackets.

Share of Gen Z and Millennials planning to buy a membership or season’s go subsequent season by family earnings:

<$20K

$20-39K

$40-59K

$60-79K

$80-99K

$100-150K

$150-199K

>$200K

66%

80%

71%

75%

68%

84%

71%

100%

When requested whether or not inflation is making them take into account altering how they entry golf, over a 3rd (35%) of Gen Z and Millennials mentioned they’re contemplating switching from paying for single rounds to buying a membership, multi-round bundle or a season go.

The first causes for this alteration are illuminating:

Key takeaways

These golf trade tendencies round Gen Z and Millennial shopping for habits present that worth is on the forefront of their determination making. These demographics are severe about golf and could be prepared to pay bigger upfront charges to a single course if it means unlocking long-term worth.

Golf operators and their groups can’t afford to miss this information; it’s important to guage loyalty packages and membership plans to make sure they supply the worth and suppleness that golfers are searching for.

Survey your golfers: Collect direct insights out of your buyer base to grasp their preferences for passes and memberships. Design your surveys thoughtfully, segmenting responses by age group, ability stage, family earnings and different related components for a extra correct image.

Provide flexibility: From tiered subscription-style memberships and intermediate plans to flex-pay choices and worth packs, create quite a lot of avenues that match completely different existence.

Unfold the phrase: With the assistance of a robust CRM and advertising and marketing instruments to gather and phase buyer information, golf amenities can create focused campaigns, analyze efficiency and make data-driven changes to maximise advertising and marketing impression.

4. Golfers flip to tech for social, laid-back, distinctive golf experiences

Off-course golf trade tendencies have grow to be main speaking factors lately, thanks partly to the accessibility of golf simulators and ball-tracking know-how.

Leisure venues like Topgolf and Drive Shack are in all places

Indoor simulators are utilized in houses and companies

Driving ranges are including Trackman or GCQuad

And a brand new golf simulator league that includes among the world’s finest gamers kicks off in 2025.

This know-how has helped off-course golf appeal to a youthful and extra numerous viewers than conventional green-grass golf.

However what’s it about these off-course venues that drive such hype? And the way does it differ from what they’re searching for from the golf course?

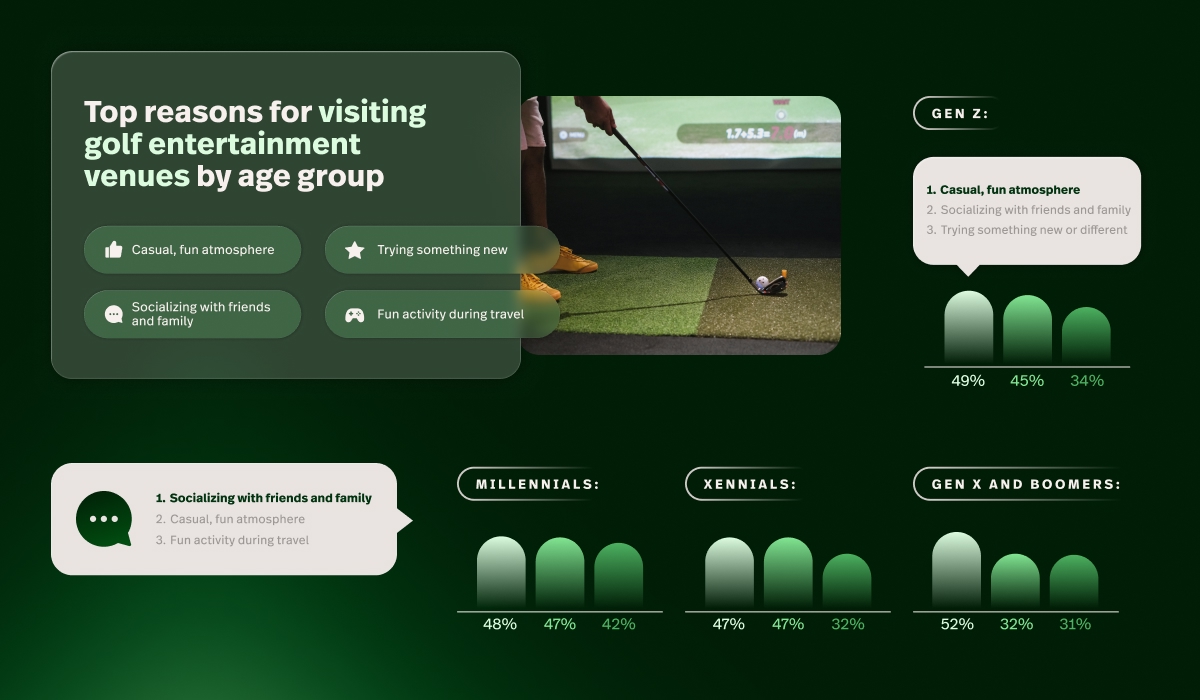

Self-care on the course, socializing off the course

We’ve seen what number of Gen Z and Millennials usually flip to green-grass golf for self-care or solo time. However when it’s time to socialize, leisure venues like Topgolf are their go-to.

When requested how golf leisure venues evaluate to conventional golf, 39% of Gen Z and Millennials mentioned they like them for an informal, social expertise.

In truth, this ambiance appealed to all age teams, with 50% of all survey respondents citing socializing with family and friends as the primary draw of those venues.

Golfers throughout all age teams clearly agree on key advantages of golf leisure venues. In ditching custom for tech, meals, drink, music and good firm, golf trade tendencies point out that these amenities supply a unique, precious golf expertise.

However with regards to really visiting these venues, there’s no query that they attraction to a youthful demographic of golf lovers.

Golfers who go to golf leisure venues by age group

Gen Z

Millennials

Gen X and Boomers

68%

62%

49%

The attraction was so sturdy {that a} exceptional 50% of all Gen Z and Millennials mentioned they might take into account changing conventional golf outings with extra visits to leisure venues.

Older generations had been much less definitive, with 34% of Gen X and Boomers saying they might take into account changing conventional golf outings.

With know-how so central to the attraction of leisure venues like Topgolf and Drive Shack, how did completely different age teams really feel in regards to the addition of different applied sciences into {the golfing} expertise?

Key takeaways

Simulators and ball monitoring know-how are serving to to gas a brand new form of golf expertise that’s enjoyable, laid again, social and agnostic of seasonality.

Quite than see these golf trade tendencies in direction of tech any type of risk, golf course operators ought to embrace these adjustments. From simulator bays to an enhanced driving vary expertise, this know-how presents amenities with the chance to scale their operations and add new providers that every one golfers will love.

Learn our weblog on making a golf simulator marketing strategy at your course

Right here’s to conserving the momentum entering into 2025

In mild of those golf trade tendencies, the long run is brilliant for customer-centric programs who’re repeatedly leveling up their operations and discovering methods to simplify, scale and supply distinctive experiences for golfers throughout all age teams.

At Lightspeed, we’re dedicated to serving bold golf programs who need to succeed and thrive—now and sooner or later. Watch a demo of Lightspeed Golf and uncover why over a thousand golf programs select our platform to run and develop their companies.

Methodology: Lightspeed initiated a shopper survey from September 26, 2024 to October 2, 2024 utilizing third get together survey vendor Medallia. 743 responses had been collected amongst Canada and the US. Respondents had been required to be over the age of 18 and to have performed at the least one spherical of golf up to now 12 months. All responses collected had been nameless.