This tutorial explains how one can join your checking account to Xero by going to the Financial institution Accounts part, finding your financial institution (or bank card account), and connecting the financial institution feeds. You’ll additionally discover ways to reconcile in Xero—which includes navigating to the reconciliation display and utilizing choices similar to matching transactions and creating new ones. Lastly, we’ll present you how one can delete a checking account in Xero if wanted.

Join Financial institution Accounts to Xero

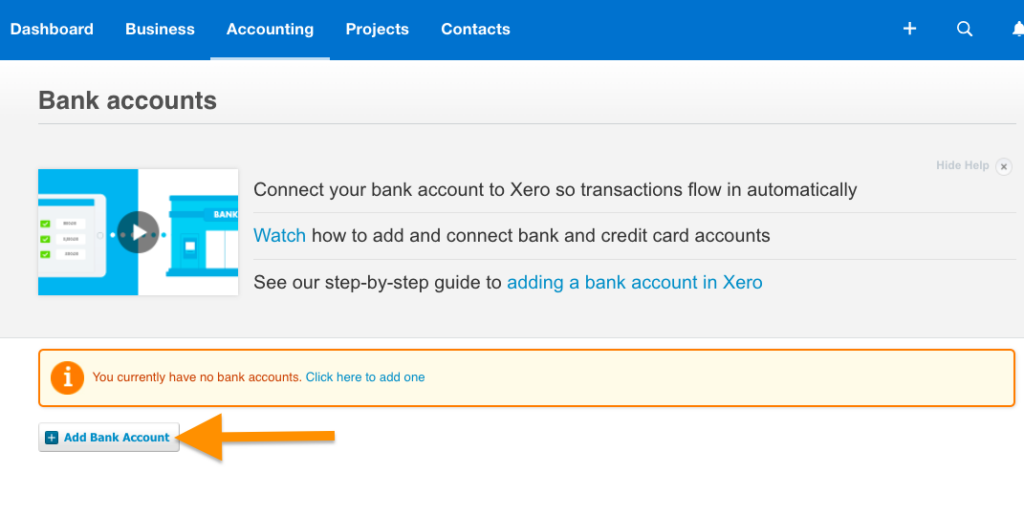

Step 1: Navigate to Financial institution Accounts

Click on on the Accounting menu on the high of the web page, after which choose Financial institution accounts, as proven under.

Navigate to Financial institution Accounts in Xero

Step 2: Choose ‘Add Financial institution Account’

On the Financial institution accounts web page, choose the Add Financial institution Account button to proceed. Word that you could add as many financial institution and bank card accounts as you want for your enterprise.

Choose “Add Financial institution Account” in Xero

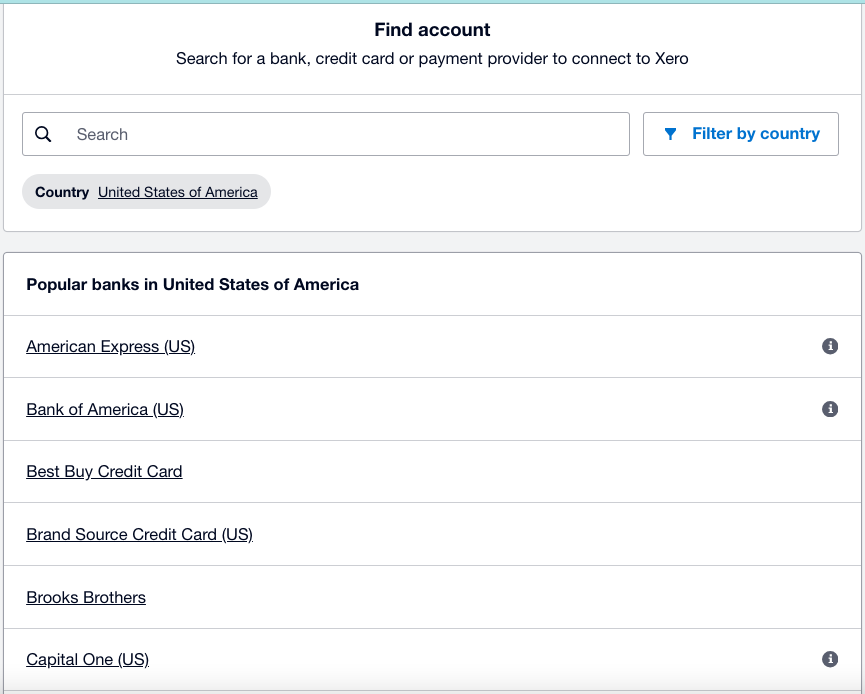

Step 3: Find Your Financial institution Account

Subsequent, Xero will show a listing of financial institution and bank card accounts supported by Xero. Discover your financial institution after which click on on it. You may additionally use the search bar on the high when you don’t see your financial institution on the listing.

Discover a financial institution to connect with Xero

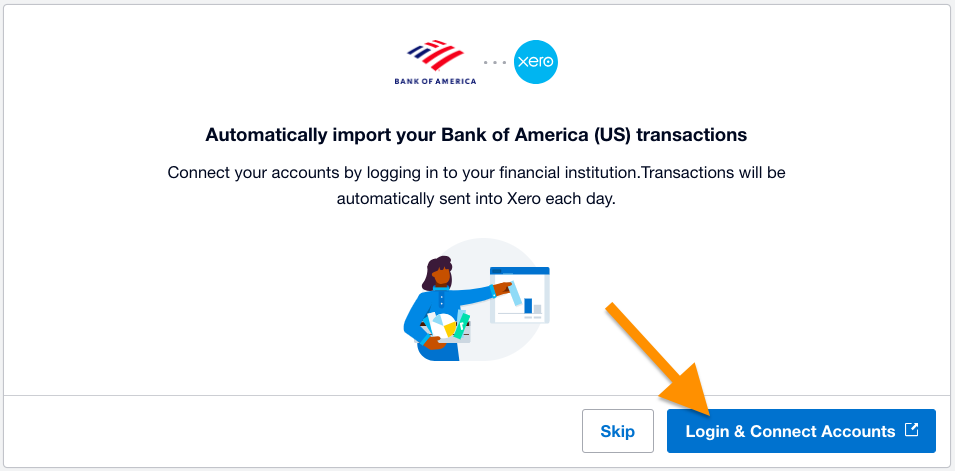

Step 4: Join Your Financial institution Account

After deciding on your financial institution, click on the Login & Join Accounts button to proceed. This may take you to a separate window the place you possibly can log in to your checking account and join it to Xero. Enter your on-line banking credentials and any required multifactor authentication (MFA).

Log in to your checking account and join it to Xero

For those who don’t see your checking account on Xero’s listing or don’t need to join it to the system, then you could manually arrange the account. To take action, click on on the Skip button (proven within the screenshot above), enter the small print, such because the account title and account kind, after which click on the Save & Proceed button within the decrease proper nook of the display. Nevertheless, observe that Xero gained’t routinely import transactions out of your financial institution, so you must add them manually.

Reconcile Financial institution Accounts in Xero

Step 1: Navigate to the Reconciliation Display screen

Navigate to the Financial institution accounts web page after which choose the financial institution you want to reconcile. Click on on the Handle account button within the higher proper nook of the financial institution panel, then choose Reconcile account, as demonstrated within the GIF under.

Navigating to financial institution reconciliation in Xero

Alternatively, you possibly can click on on the blue Reconcile [X] gadgets button within the decrease left nook of the financial institution panel. When a financial institution assertion is imported, the checking account panel reveals the variety of financial institution assertion strains which can be able to be reconciled. For those who don’t see the Reconcile [X] gadgets button, there aren’t any assertion strains to reconcile.

Step 2: Carry out the Reconciliation

After clicking the Reconcile account button, Xero will take you to the reconciliation display with a side-by-side format. On the left facet of the display, you’ll see a listing of all of the transactions which were imported into Xero. On the best, you’ll see attainable matches and choices to reconcile the transactions on the left.

On the higher left nook of the reconciliation display, you’ll see the Assertion Steadiness and the Steadiness in Xero. As you reconcile every transaction, the variations between the 2 balances ought to get nearer, and your aim is to convey the distinction all the way down to zero.

To reconcile the transactions, you might be supplied with 4 choices: Match, Create, Switch, and Talk about.

1. Match

Xero will routinely attempt to match the transaction on the left with a corresponding transaction in your Xero information on the best. If it finds a attainable match, it is going to show it on the best, highlighted in gentle inexperienced. Verify that the transactions match; in the event that they do, click on the OK button to reconcile the transaction.

Matching transactions in Xero

If Xero doesn’t discover a match, you’ll use the Discover & Match button to manually seek for the right transaction in your Xero information. Choose the transaction, after which click on the OK button to reconcile it.

Word that there are some situations the place you could choose a number of transactions to match the only transaction on the left. As an illustration, this might occur in case you have a single fee or deposit that corresponds to a number of smaller transactions in Xero, which is analogous to the case illustrated within the GIF under.

Discovering a Xero transaction to match a financial institution transaction throughout the reconciliation course of in Xero

2. Create

If the transaction on the left has no corresponding match in your Xero document, then click on on the Create button. From right here, Xero will ask for the important info, together with:

Who: Choose the contact related to the transaction. This may very well be a vendor or buyer relying on the transaction.

What: This area allows you to specify the account code to document the transaction.

Why: Enter the aim or purpose for the transaction.

As soon as the transaction is created, click on OK to reconcile it.

3. Switch

Use the Switch possibility when you’ll want to transfer funds between financial institution accounts in Xero. As an illustration, while you pay a bank card stability utilizing cash out of your checking account, use the Switch choice to match the fee to the bank card account. You solely have to create a switch transaction in a single checking account—Xero will create the transaction within the corresponding account.

4. Talk about

You should use the Talk about possibility when you’re not sure a couple of transaction. You possibly can depart a observe (e.g., talk about with my accountant), after which click on Save to document it. You possibly can then come again to the transaction later to finalize it.

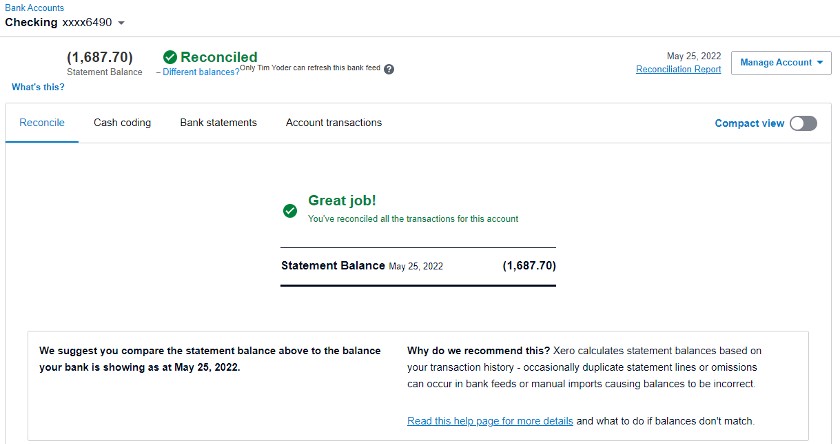

Step 3: Finalize the Reconciliation

As soon as all transactions have been efficiently reconciled and your financial institution stability and Xero stability match, the financial institution reconciliation is full.

Reconciled checking account in Xero

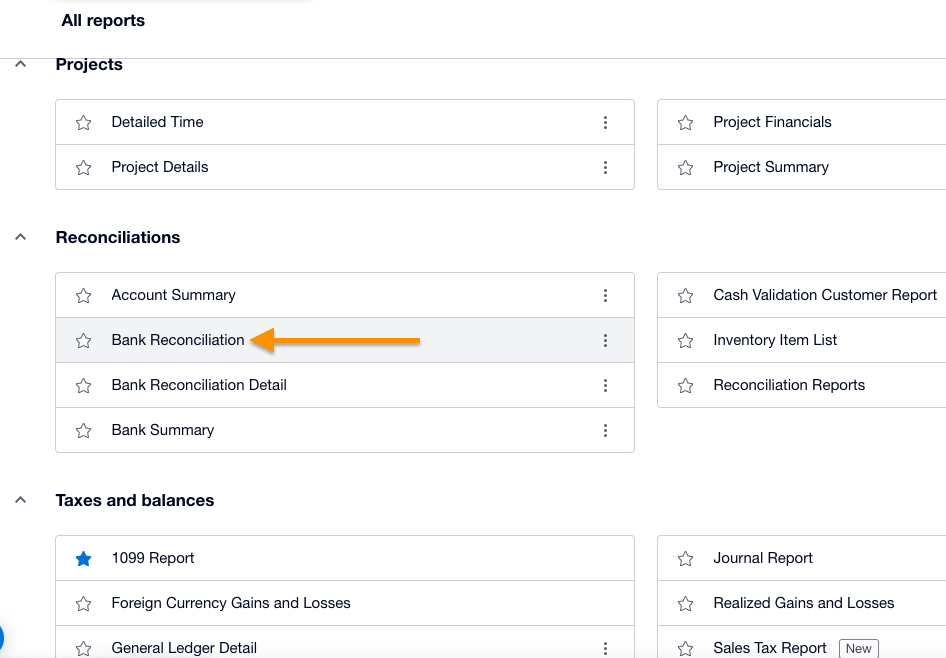

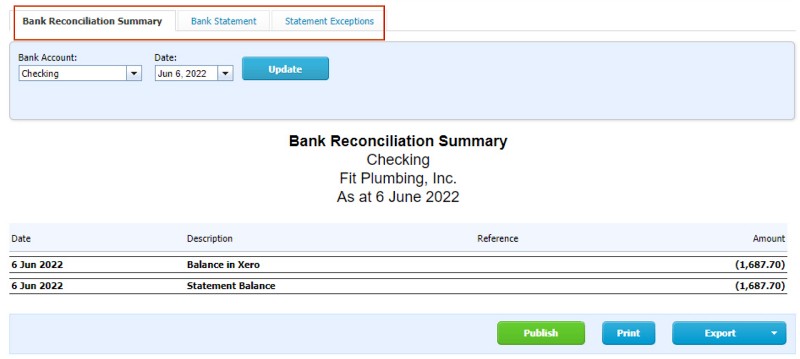

Step 4: View Financial institution Reconciliation Abstract Report

To additional verify that your precise financial institution stability and the checking account stability in Xero match, you possibly can run a Financial institution Reconciliation Abstract report. That is helpful in case your balances don’t match as a result of it permits you to examine for lacking, duplicated, or deleted transactions.

To do that, navigate to Experiences underneath the Accounting menu after which find and open the Financial institution Reconciliation Abstract report.

Operating a Financial institution Reconciliation Abstract report in Xero

Choose the checking account and the date to customise the report, after which click on on the Replace button to generate the report.

Pattern Financial institution Reconciliation Abstract report in Xero

The report consists of three tabs:

Financial institution Reconciliation Abstract: The abstract breaks up into sections to point out your precise financial institution stability based mostly on the information you entered into Xero on any given date. It isn’t taken out of your on-line financial institution stability however reasonably calculated utilizing the information in Xero.

Financial institution Assertion: This reveals you a listing of all assertion strains downloaded for the present month by default, the date the merchandise was imported from the assertion into Xero, whether or not the merchandise was reconciled, and the place every assertion line got here from.

Assertion Exceptions: This reveals any gadgets which can be exceptions to the common reconciliation course of in Xero. It shows gadgets which can be in Xero and are manually reconciled, imported assertion gadgets which can be deleted in Xero, and duplicates. It is a good place to examine in case your on-line checking account stability doesn’t match the stability proven in Xero.

Delete a Financial institution Account in Xero

For those who want to delete a checking account in Xero, navigate to Chart of Accounts underneath the Accounting menu. Then, choose the checkbox subsequent to the account that you just need to delete, choose Delete, after which click on OK.

Deleting a checking account in Xero

Ceaselessly Requested Questions (FAQs)

Can I join a number of financial institution and bank card accounts to Xero?

Sure, you possibly can join as many accounts as wanted.

How usually are financial institution transactions imported to Xero?

With a financial institution connection, transactions are imported into Xero each 24 hours.

Backside Line

You have got now discovered how one can handle and reconcile financial institution accounts in Xero. The following and closing tutorial in our collection of Xero programs is how one can create and print customized studies, which can cowl how one can navigate to studies, what studies can be found, and how one can set primary choices.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23986640/acastro_STK092_04.jpg)