The Federal Unemployment Tax Act (FUTA) tax is what employers pay the Inner Income Service (IRS) to fund the unemployment program that pays eligible staff who’ve misplaced their jobs. That is separate from state unemployment taxes (SUTA). Federal rules solely require employers to pay a most of 6% on every worker’s first $7,000 of earnings. On the finish of every yr, you’ll use Kind 940 to find out and report the full quantity of FUTA taxes you owe and have paid.

If you wish to automate FUTA tax funds and submitting, think about using a payroll resolution like Gusto. Gusto tracks earnings and calculates your FUTA taxes per worker as much as the required threshold. It additionally remits your taxes to the IRS quarterly, making certain you aren’t penalized for ready till year-end to pay. Join at the moment.

Go to Gusto

Who Pays FUTA Tax

Whereas FUTA taxes are calculated and processed each time you do payroll, these aren’t deducted from worker wages. As an employer, it’s a must to pay FUTA tax in case you meet the next necessities:

Paid $1,500 or extra in worker wages throughout a calendar quarter of this yr or the earlier yr

Employed a number of full-time, part-time, or momentary staff for a minimum of some a part of the day in any 20 or extra totally different weeks within the present or earlier yr

Employed family workers (somebody who performs house responsibilities in a house, school membership, or fraternity/sorority) and paid greater than $1,000 in wages in 1 / 4

Paid a farmworker greater than $20,000 money wages throughout any calendar yr or employed 10 or extra farmworkers throughout any 20 or extra totally different weeks within the present or previous calendar yr

Did You Know? Spiritual, instructional, scientific, charitable, and different 501(c)(3) organizations which are exempt from tax beneath part 501(a) don’t must pay FUTA taxes or file Kind 940. Moreover, FUTA doesn’t apply to contract staff.

How FUTA Tax Is Calculated

The utmost tax fee for FUTA tax is 6%. The tax is utilized to the primary $7,000 of every worker’s earnings. This consists of ideas, commissions, and different funds, together with transferring bills. Nevertheless, fringe advantages—like meals and contributions to worker well being plans, life insurance coverage, and retirement accounts—are exempt.

Listed here are some examples:

In the event you paid an worker $5,000 in a yr, the FUTA tax computation can be:

$5,000 × 0.06 or 6% = $300

If the worker earns $11,500 and also you solely pay FUTA tax on the primary $7,000, the computation can be:

$7,000 × 0.06 or 6% = $420

Word that states may additionally have unemployment taxes beneath the SUTA. A number of states even permit worker contributions to SUTA (like Alaska, for instance, the place employers pay 73% of the prices and workers pay the remaining 27%). If your small business is required to pay SUTA tax, chances are you’ll get a tax credit score from the federal authorities, which might scale back your FUTA tax by as a lot as 5.4%.

For instance, in case you pay SUTA tax and get a 5.4% credit score in your FUTA tax, then your FUTA tax fee is simply 0.6%. So, if an worker earns $5,000 in a yr, the computation can be:

$5,000 × 0.006 or 0.6% = $30

In the event you paid an worker $11,000 a yr and also you solely apply FUTA tax to the primary $7,000, the computation can be:

$7,000 × 0.006 or 0.6% = $42

For a faster means of figuring out what you’ll owe if in case you have a FUTA tax credit score, use our calculator.

Need assistance with extra payroll calculations? Try our information on calculate payroll.

FUTA Credit score Discount States

Some states borrow cash from the federal authorities to pay unemployment advantages to state residents. In the event that they don’t pay the federal authorities again, they grow to be a credit-reduction state. For employers, because of this you’ll pay a better FUTA tax fee as the federal government reduces SUTA tax credit by 0.3% for every year that the state owes on its mortgage.

When FUTA Tax Funds Are Due

The quantity of your FUTA tax legal responsibility determines when it ought to be paid. Funds could be made yearly or quarterly. In case your FUTA tax is over $500 for the calendar yr, it is advisable deposit a minimum of one quarterly fee after which remit the remaining quantity by the fourth quarter.

In case your FUTA tax is lower than $500 in a calendar quarter, carry it over to the subsequent quarter. You may proceed carrying the tax legal responsibility over till the cumulative FUTA tax is greater than $500. Nevertheless, it’s a must to pay your entire quantity—even when it by no means exceeds $500—by January 31 of the subsequent calendar yr. In case your FUTA tax steadiness exceeds $500 and also you don’t ship in quarterly funds, you could be charged penalties.

FUTA tax funds have to be deposited by the final day of the month after the tip of the calendar quarter. For instance, for the second quarter ending on June 30, the due date can be July 31. If the fee date falls on a Saturday, Sunday, or authorized vacation, you possibly can deposit on the subsequent enterprise day.

Tips on how to Pay FUTA Taxes

You want to pay FUTA taxes by way of the Digital Federal Tax Fee System (EFTPS). This can be a free system offered by the Division of Treasury for paying federal taxes. You may enroll on-line by way of the EFTPS web site or name 800-555-447 Monday by way of Friday, 9:00 a.m. to six:00 p.m. Japanese time (ET).

When you have a payroll service, your supplier could make FUTA tax funds for you. Nevertheless, the IRS recommends that you just create an EFTPS account anyway in an effort to test funds, change firms, and have the choice to deposit funds your self.

FUTA tax funds have to be submitted by 8:00 p.m. ET a minimum of one calendar day earlier than the tax due date. In extraordinary circumstances, same-day wire funds are allowed. Word that such a transaction requires a Identical-Day Fee Work Sheet, which you will discover on the EFTPS web site. Submit each filled-out pages to your monetary establishment.

When to File FUTA Tax on Kind 940

Whereas FUTA tax funds could require quarterly funds, submitting of Kind 940 to report your taxes owed ought to be carried out by January 31 of the yr following the yr it is advisable report. Nevertheless, in case you deposited all of your FUTA taxes quarterly after they had been due, you possibly can file as late as February 10.

In the event you’re questioning the place to file Kind 940, the IRS prefers that you just submit your type electronically. You even have the choice to mail it, however you could use the U.S. Postal Service, as most supply providers is not going to ship to P.O. containers. There are totally different addresses relying on the state. You may test the Kind 940 directions for the suitable mailing addresses.

The place to Get Kind 940

You may get Kind 940 from the IRS web site. It’s an interactive doc that means that you can fill out particular information fields on-line after which print them when you’re carried out. You too can obtain and print the shape with out filling it out electronically.

Kind 940 is utilized by most companies, however some firms in particular industries want a special type, equivalent to Kind 943 for agricultural workers. You may test the IRS web site in case you assume you require a tax doc apart from Kind 940.

Word that the IRS sometimes releases annual variations of Kind 940. Examine the IRS web site towards the tip of the calendar yr if an up to date type has been posted.

Tips on how to Full Kind 940

To finish Kind 940, it’s a must to present details about your small business, whole worker earnings, and FUTA tax particulars. The shape has the next sections:

Normal data: That is the place you enter your contact data and employer identification quantity (EIN). Fill out the commerce title field if your small business operates beneath a reputation totally different from your small business’ authorized title. Examine the field to the correct (titled Sort of Return) to see if any of the circumstances apply to you; usually, they gained’t.

Half 1: Point out whether or not you paid unemployment tax in a single state. In the event you’re a multistate employer and/or one of many states is a credit score discount state, it’s a must to connect a accomplished Schedule A type. Except all of your workers are exempt from state unemployment taxes, you could fill out this part.

Half 2: Calculate the full FUTA that you just owe. The shape asks for whole wages, exempt wages, and wage funds made to every worker incomes over $7,000 (you possibly can test the Kind 940 Directions for different taxable FUTA wages). Then, multiply the full quantity by 0.6% (0.006) to find out your base quantity.

Half 3: Calculate any changes it is advisable make to your FUTA calculation. That is required in case you had been both partially or absolutely exempt from SUTA taxes. You’ll want so as to add in any FUTA quantities that you just didn’t pay SUTA on. Word that in case you’re a multistate employer, chances are you’ll want a accomplished Kind 940 Schedule A for this part.

Half 4: Comply with the shape’s instructions to find out your FUTA owed. In the event you by accident overpaid, you possibly can select to use the surplus to your subsequent FUTA tax fee or have the IRS ship you a refund of the steadiness.

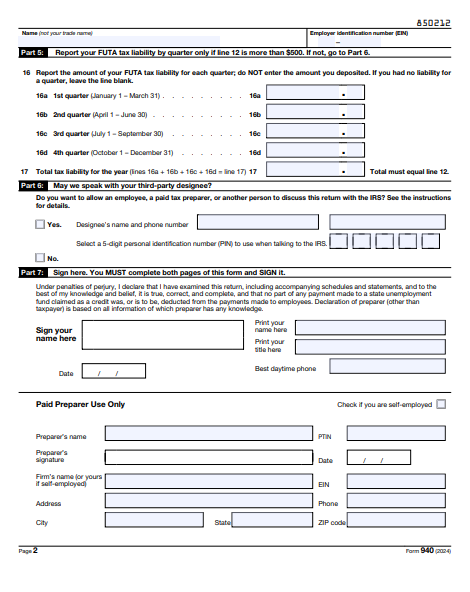

Half 5: Present your whole FUTA legal responsibility for every quarter. If the FUTA reported on line 12 (in Half 4) is lower than $500, skip this part.

Half 6: When you have a 3rd get together dealing with your accounts and need to permit the IRS to contact them for questions, fill out this part. This must be the title of a selected individual, not a company’s title or an individual’s job title. You and your designee want to decide on a five-digit PIN that the IRS will use to substantiate the individual’s id when speaking to them.

Half 7: Signal and print your title and provides the cellphone quantity for contacting you in the course of the day.

Need to find out about extra payroll tax varieties that employers are chargeable for finishing? Try our information on payroll varieties.