I’ll present you easy methods to use the QuickBooks audit path to trace modifications made to your organization file. I’ll information you on easy methods to entry the audit log and the way you should utilize the filter choices to find particular entries you need to evaluation. I’ll additionally present some tips about how one can successfully evaluation modifications and share the advantages of utilizing the audit path in QuickBooks.

Step 1: Entry the Audit Log

First, I click on on the cogwheel icon (⚙︎) within the higher proper nook of my dashboard after which choose Audit log beneath the Instruments menu, as proven beneath.

Navigate to Audit log in QuickBooks On-line

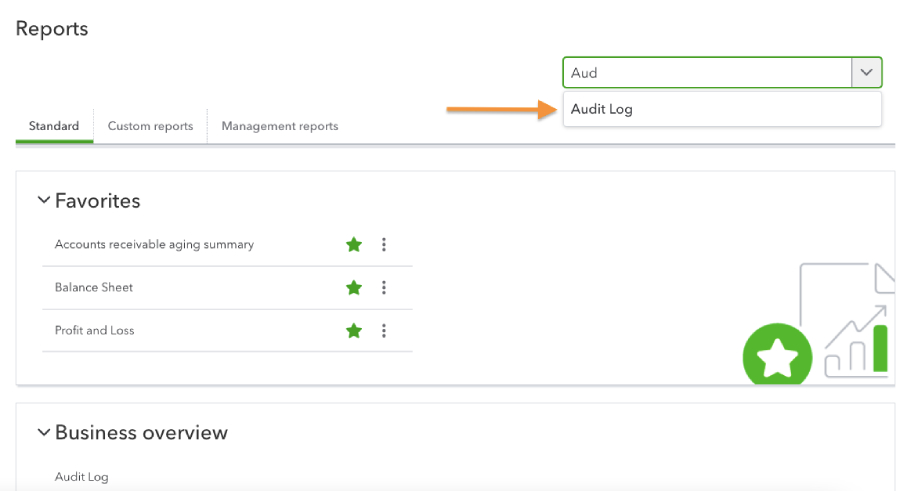

One other manner you’ll be able to entry the audit log is to go to the Reviews part and find the Audit log report from the drop-down menu.

Entry Audit log from the Reviews part in QuickBooks

It’s worthwhile to sign up as an admin consumer to have the ability to entry the audit log. Additionally, be aware that for audit and safety causes, there’s no choice to show the audit log in QuickBooks On-line off.

Step 2: Assessment the Audit Log Entries

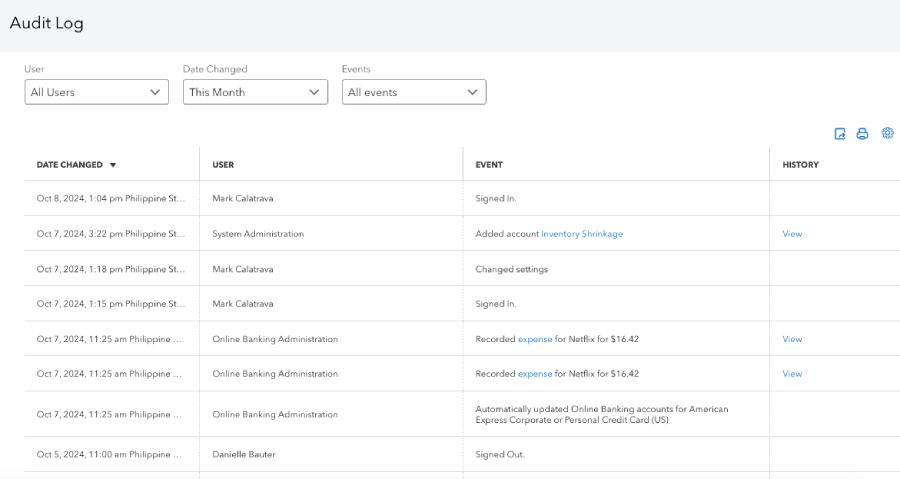

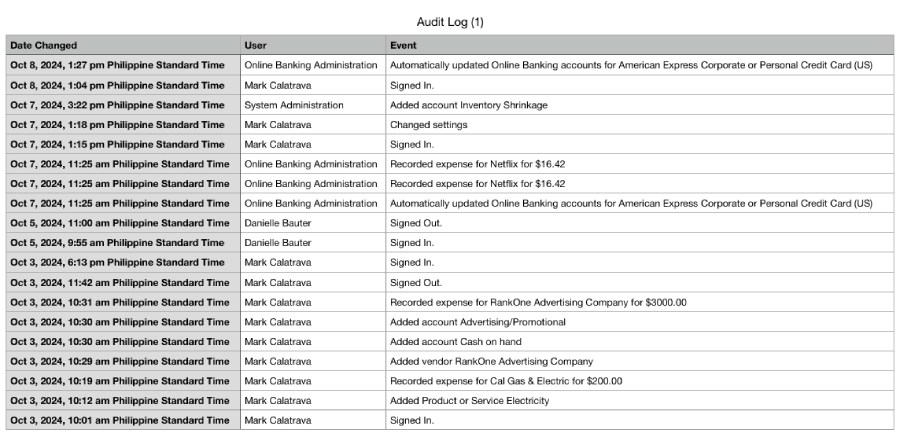

The audit log gives you with a listing of actions recorded in a QuickBooks On-line account. This contains all actions made by customers, together with modifications to transactions, updates to buyer info, and modifications to accounts.

I scroll via the entries to evaluation the modifications which have been made in my firm file. The entries are organized in chronological order, so the latest actions seem on the high. If I need to evaluation older entries, then I merely click on on the following web page beneath the display.

Audit log in QuickBooks On-line

As you’ll be able to see within the screenshot above, there are 4 columns within the audit log:

Date modified reveals the date and time the motion occurred.

Consumer signifies the precise consumer who made the modifications.

Occasion specifies the kind of motion made (e.g., signed in and adjusted settings).

Historical past reveals a View button that lets you see extra detailed details about the motion. Nevertheless, not all entries have this button as some actions don’t want further particulars.

You may even see one thing known as an oblique edit. This occurs when somebody makes a change to a transaction with out instantly enhancing the unique entry. As an example, when a consumer modifications the cost technique for a vendor cost that has already been recorded, QuickBooks will log it as an oblique edit.

Be taught About QuickBooks On-line Audit Log Customers

In some instances, you may even see some automated consumer profiles that you simply don’t acknowledge, corresponding to:

On-line Banking Administration: This refers to QuickBooks On-line robotically making modifications associated to financial institution accounts, corresponding to downloading transactions or updating account balances.

Help Consultant: This can be a QuickBooks On-line help guide who made modifications to your account. For instance, if an agent helps you repair a transaction error, the modifications can be recorded within the log beneath the Help Consultant consumer profile.

System Administration: This displays modifications made robotically by QuickBooks On-line as a consequence of a number of causes (e.g., you arrange a third-party integration or created a recurring transaction).

Import Administration: This logs any modifications associated to the conversion of knowledge from QuickBooks Desktop to On-line.

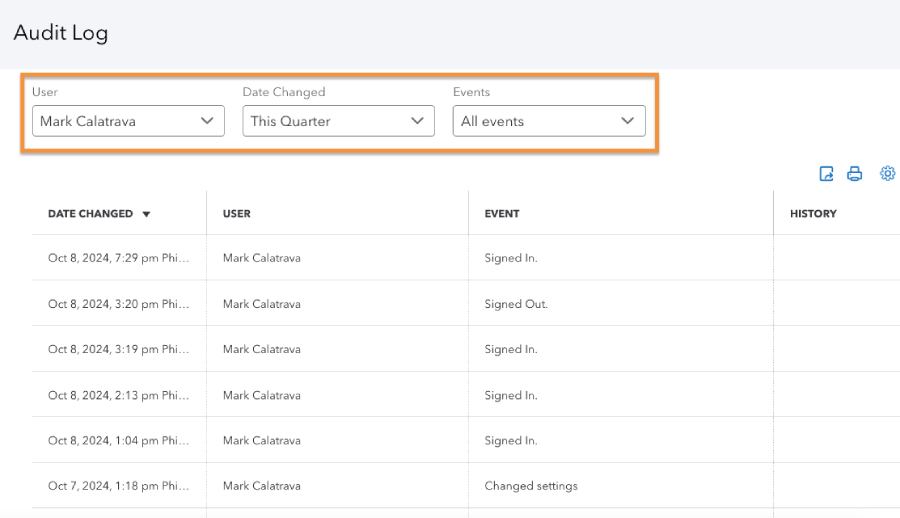

Step 3: Filter the Audit Log

To make it simpler to search out the data you want, use the filter choices on the high of the audit log entries. Within the screenshot beneath, I’ve filtered the outcomes to point out solely the modifications I made to any transactions throughout this quarter.

Utilizing the audit log filters in QuickBooks On-line

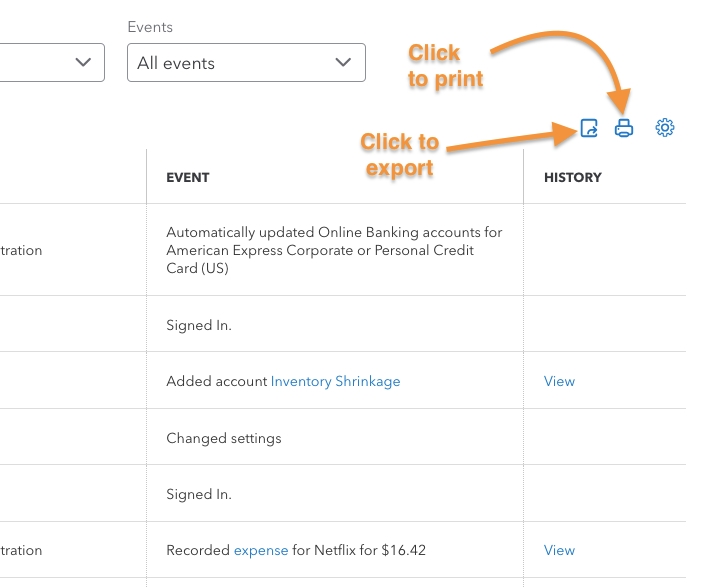

Step 4: Obtain and Print the Audit Log if Wanted

If wanted, obtain and print the audit log by clicking the respective buttons within the higher proper nook of the audit log display.

Exporting and printing an audit log in QuickBooks On-line

Once you click on the export button, QuickBooks will immediately obtain the audit log in a CSV format, just like the pattern file beneath.

Downloaded audit log in QuickBooks On-line

In the meantime, once you click on print, QuickBooks will show a printable model of the audit log and on-screen prompts to print the file. Upon getting the copy, you’ll be able to evaluation the modifications totally and even share the copy with different workforce members.

Suggestions for Reviewing QuickBooks Audit Log Entries

Under, I’ll share a couple of methods that can enable you evaluation your audit path in QuickBooks On-line successfully:

Assessment the audit log recurrently. Make it a behavior to evaluation your audit log recurrently so that you simply don’t miss any essential modifications. I often schedule it on a weekly or month-to-month foundation.

Use filters. If there’s a selected consumer exercise you need to evaluation, then use the filtering choices to simply find the entries wanted.

Examine uncommon actions. Look into any uncommon modifications that could possibly be an indication of potential points. As an example, should you discover surprising funds to distributors or unusually excessive bills, this could possibly be an indication of fraudulent exercise.

Search for developments and patterns. For instance, should you discover a workforce member making frequent modifications to the identical transaction, it might imply that they don’t totally perceive the system’s options or correct procedures.

Cross-reference with different data. To confirm the accuracy of your data, cross-reference the modifications with different data. As an example, I evaluate the entries with my financial institution statements to verify that the transactions match the precise deposits and withdrawals from my financial institution.

QuickBooks Audit Log Advantages

Utilizing the audit log in QuickBooks On-line helps me:

Detects and prevents fraud: As talked about earlier, reviewing the audit log helps detect any uncommon or suspicious actions that may be an indication of fraudulent exercise.

Improves accountability amongst workforce members: If there are discrepancies, you’ll be able to simply pinpoint who was answerable for the change. Since workforce members know that their actions are being monitored, they’ll guarantee to comply with correct procedures.

Ensures knowledge accuracy: By reviewing the audit log, you’ll see all modifications made to monetary knowledge and ensure whether or not the entries are correct.

Resolves points rapidly: The audit log lets you hint again consumer actions rapidly, serving to establish the supply of the issue.

Continuously Requested Questions (FAQs)

Can I delete the audit path in QuickBooks Desktop?

No, you’ll be able to’t, because it’s designed to take care of a everlasting file of transactions and modifications made to your organization file.

Is there a solution to see deleted transactions in QuickBooks?

Sure, you’ll be able to view deleted transactions via the audit log. It is going to present you any transactions which have been deleted, who deleted them, and once they had been deleted.

How do I examine QuickBooks logs?

To examine logs in QuickBooks, navigate to the audit log by clicking the gear icon and choosing Audit Log beneath Instruments. It’s also possible to entry it via the Reviews menu by finding the Audit log report.

Wrap Up

There you go—that’s how I successfully use the QuickBooks audit path. If you wish to be taught extra in regards to the different options of QuickBooks On-line, I like to recommend exploring our free QuickBooks On-line tutorials.