Listed property consists of things that can be utilized for enterprise and private functions. They embrace the next classes:

Passenger autos are outlined as any four-wheeled automobile supposed to be used on public streets and weighing not more than 6,000 kilos.

Tools designated for leisure and leisure use, comparable to images and audio/visible tools.

Different property used for transit would come with planes, trains, and boats—aside from certified nonpersonal use autos

An ambulance, hearse, police automotive, or college bus can be thought-about certified nonpersonal use autos—so long as every is clearly marked for official use.

, that are typically designed for restricted private use

Forklifts and rubbish vans would have restricted private use as a consequence of their design.

.

Property that’s solely utilized in a commerce or enterprise is just not thought-about listed property. The IRS has particular guidelines for listed property to stop taxpayers from abusing the deduction for mixed-use property.

Key Takeaways:

With the Tax Cuts and Jobs Act (TCJA), computer systems, laptop equipment, and cell telephones are exempt from the IRS’s definition of listed property.

If enterprise use of listed property is:

Over 50%, depreciation might be claimed utilizing both common or accelerated depreciation strategies

50% or much less, depreciation can solely be claimed utilizing the straight-line (SL) methodology. Depreciation taken in extra of the SL methodology in earlier years is topic to tax.

To take any deduction, detailed information displaying the division of non-public and enterprise use have to be maintained.

Particular Guidelines for Depreciating Listed Property

The foundations for depreciation of listed property differ relying on the quantity of enterprise use.

Depreciation for Listed Property With Enterprise Use of Over 50%

Listed property with enterprise use of greater than 50% is eligible for each common and accelerated depreciation strategies. Accelerated depreciation permits for the taxpayer to take a bigger portion of the price of the asset as an upfront deduction as an alternative of taking smaller quantities evenly over time.

The first strategies of accelerated depreciation are:

For listed property, solely the enterprise share of the asset might be depreciated or deducted. The deduction have to be substantiated by thorough information.

Depreciation for Listed Property With Enterprise Use of fifty% or Much less

If enterprise use for the property is 50% or much less, accelerated depreciation strategies aren’t permitted, and SL depreciation have to be used. Beneath this methodology, the price of the asset is deducted evenly over a prescribed interval. The IRS has established the intervals over which completely different lessons of property might be depreciated.

For listed property, solely the enterprise use share can be depreciated or deducted underneath part 179. With accelerated depreciation strategies, you possibly can deduct a bigger share of the price of the asset as a deduction than you might with SL depreciation.

Depreciation Recapture for Much less Than 50% Enterprise Use

When you initially use listed property for greater than 50% enterprise however then in a later yr cut back the use to beneath 50%, you have to pay tax on the surplus depreciation taken. The tax relies on the distinction between SL depreciation for these property and the accelerated depreciation methodology that you simply really used.

That distinction will likely be taxed at unusual revenue charges and apply to the primary yr that your small business use was lower than 50%. This revenue is reported on Type 4797, Half II, which then transfers to your private Type 1040, line 14.

Examples of Listed Property Depreciation

The next examples illustrate how listed property is depreciated.

50% or Extra Enterprise Use

Lou offers violin classes to native college students. His enterprise is organized as a sole proprietorship. Lou bought a $1,500 studio sound equipment that he makes use of to supply college students with recordings of their studio periods. He additionally makes use of the sound equipment for private causes.

Based mostly on his detailed information, he calculates the enterprise utilization of the studio equipment to be 60%. Since Lou’s enterprise use is larger than 50%, Lou can use the part 179 election to completely expense the enterprise portion of the recording equipment’s price within the yr of buy.

Lou would report the acquisition of this listed property in Half V of IRS Type 4562 and take a $900 deduction for 2023.

Type 4562, Half V, Pattern Enter: 50% or Larger Enterprise Use

Lower than 50% Enterprise Use

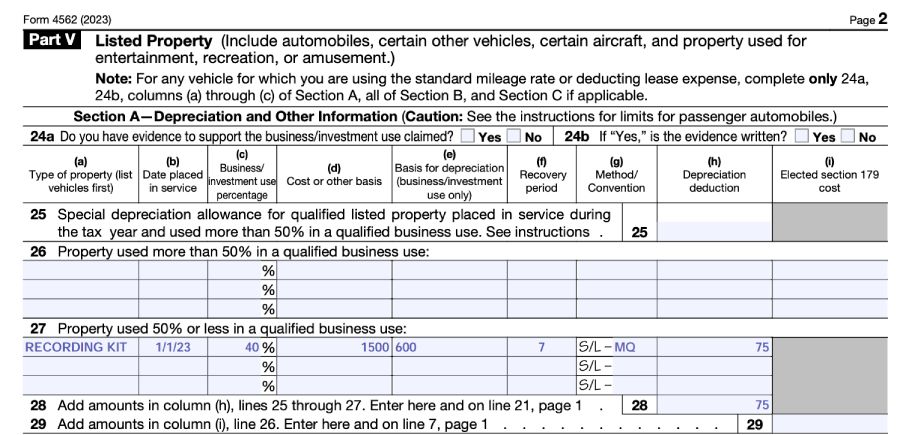

Let’s now assume the identical truth sample for Lou, however on this situation, he calculated his enterprise use share to be 40%. Since Lou’s enterprise use is lower than 50%, Lou might not speed up the depreciation of the studio recording equipment; it have to be depreciated on the SL foundation.

He ought to report the acquisition of this listed property in Half V of IRS Type 4562 and report a $75 deduction for the yr.

Type 4562, Half V, Pattern Enter: Lower than 50% Enterprise Use

Recapture When Enterprise Use Drops Beneath 50%

Now let’s take a look at what occurs if a taxpayer has a 60% enterprise use within the first yr however then the enterprise use drops to 40% within the second yr. Let’s assume that Lou purchases tools with a five-year life for $10,000. He desires to make use of the double-declining-balance (DDB) when allowed and doesn’t declare part 179.

In yr 1, Lou claims $1,200 of depreciation expense calculated as follows:

$10,000 × 60% = $6,000 depreciable foundation

$6,000 × 20% (issue from MACRS DDB desk for yr 1) = $1,200

In yr 2, Lou should use SL depreciation for the reason that business-use share is lower than 50%. He can declare depreciation of $800.

$10,000 × 40% = $4,000 depreciable foundation

$4,000 ÷ 5 yr life = $800

Along with having a lowered depreciation quantity in yr 2, Lou should additionally acknowledge revenue for the recapture of extra depreciation in yr 1.

12 months 1 SL depreciation would have been:

$10,000 × 60% = $6,000 depreciable foundation

$6,000 ÷ 5 = $1,200 full-year depreciation

$1,200 ÷ 2 = $600 half-year depreciation for the preliminary yr of service

Recapture quantity is:

$1,200 (precise depreciation) − $600 (SL depreciation) = $600

Beneath is a abstract of the outcomes for Lou in years one and two:

Recordkeeping Necessities

Logging your utilization of the listed property is required. No deduction (accelerated or in any other case) is permitted with out correct information. For autos used for enterprise and private functions, a mileage log ought to present enough proof of enterprise utilization.

Utilization information for all different properties needs to be logged with the next info:

Dates of utilization

Period of utilization

Enterprise motive for utilization of the property; info supplied right here ought to embrace sufficient element for a potential auditor to establish the enterprise intent of the exercise

Buy and restore prices for the asset

Steadily Requested Questions (FAQs)

Can you are taking 100% bonus depreciation on listed property?

No. Whereas bonus depreciation is permissible for listed property used greater than 50% for enterprise, underneath present IRS statute, 2022 was the final yr that 100% bonus depreciation could possibly be taken for any property, barring any modifications to the regulation.

What are examples of listed property?

Examples of listed property embrace autos and tools designated for leisure and leisure use.

Is there depreciation recapture on listed property?

Depreciation recapture can happen on listed property when enterprise use drops beneath 50% and accelerated depreciation was beforehand taken.

Backside Line

Listed property contains property which are used for each enterprise and private use. If enterprise use drops beneath 50%, further tax could also be assessed on the depreciation taken in extra of what would have been taken utilizing the SL methodology. Detailed information have to be maintained displaying the division of non-public and enterprise use, or the IRS might disallow the deduction.